The financial sector has always been a primary target of criminals. Therefore, to improve the security and regulatory compliance of financial organizations, the Federal Government created laws, such as anti-money laundering and combating the financing of terrorism (AML/CFT).

Accordingly, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act) added more AML and Know Your Customer (KYC) regulations for financial institutions. The law helps banking organizations deter criminals from infiltrating their networks and counter illegal schemes, including money laundering, terrorism financing, and fraud.

Financial institutions are also mandated to implement security protocols for identity verification when an individual is opening a bank account or making a deposit or withdrawal transaction to ensure that they are transacting with the legitimate identity owner. Identity authentication measures also block criminals from accessing a business’s network and counter their illegal activities.

Identity proofing also allows financial firms to maintain their reputation and consumer trust and secure entrusted data and funds. However, with the continuous progression of technology and the shift of businesses and their clients to electronic banking, conventional authentication processes become inadequate in impeding criminals’ illegal schemes.

Cybercriminals utilize stolen information, commit fraud, and use synthetic identities to evade identity proofing protocols. They are also using more creative and sophisticated methods and are leveraging technology to breach banking systems.

To ensure that they are employing the necessary identity verification methods to protect their organizations and their clients, financial services firms must keep up with industry trends, regulatory compliance, and technological innovations. They must also replace outdated, manual checks with modern, innovative solutions for digital identity verification to improve their security measures. Failure to implement identity verification processes will result in costly consequences, such as revenue loss and customer distrust.

Banking firms use various identity verification solutions to assure their clients that they can protect their confidential data and funds and deter criminals from infiltrating their systems. Some use multi-factor authentication solutions, which typically include biometric authentication. These innovative solutions effectively prevent unauthorized individuals from accessing banking companies’ services, especially when customers access services through online banking.

Furthermore, financial organizations also use digital identity document authentication to complement their identity verification solutions. Digital document verification allows customers to have their credentials conveniently verified remotely rather than in-person. The document authentication process asks clients to take photos of their ID documents, such as National ID, passport, or driver’s license, and submit the document’s image for validation.

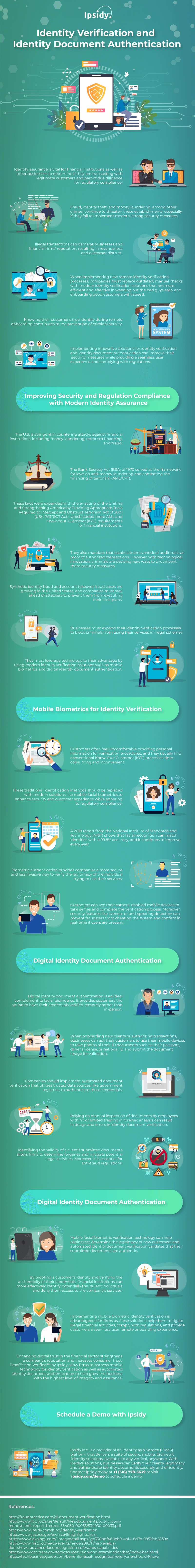

This infographic from Ipsidy discusses more on identity verification and identity document authentication.