Getting a car is one of many people’s dreams, and they’ll likely want to get the best ones in the market. Many Alabang residents fight other commuters to get to busses, jeeps, and other public transportation, and they also have to endure the stress of traffic with strangers. With a car, people won’t have to compete with other commuters and go through the stress of being stuck on the road with strangers as they sit comfortably in their private cars.

Once Alabang residents get the car of their dreams, they can have an easier time going from one place to another, especially when Luzon was in lockdown, and there was no public transportation system. Such cars are usually expensive, and it’s financially exhausting when their owners lose the car or suffer damages from the weather, collisions, or thieves. Car Insurance Alabang can help local car owners stay financially protected from accidents.

Because not all drivers are responsible enough to be careful with how they drive, various auto accidents can occur. These drivers also usually lack any insurance, even the mandatory compulsory third party liability or CTPL insurance. Because they aren’t insured, they won’t be able to cover any damage you sustain when they’re at fault.

Many Filipino car owners avoid getting insured since they think it’s merely another unnecessary expense. They settle with CTPL while failing to protect their own property should accidents occur. Should another Ondoy happen, many people will likely end up heartbroken when they lose their cars without getting the money they need to replace them.

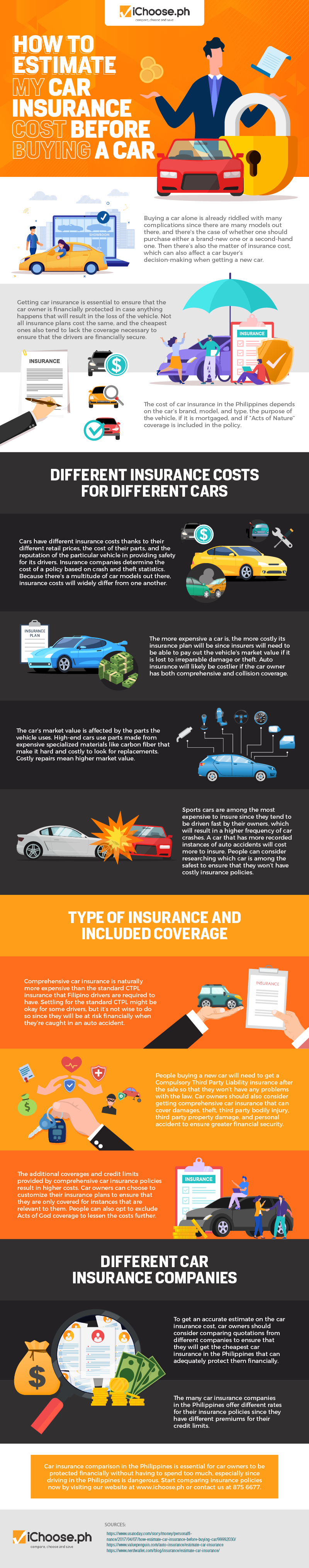

People can estimate their insurance costs even before buying a car by checking out the vehicle’s retail price. The more expensive the car is, the more expensive the insurance plan. The vehicle’s spare parts and reputation can also influence the insurance plan’s price.

The type of insurance plan people will get also affects how much people have to pay to get insured. CTPL is cheaper than a comprehensive car insurance plan because of its limited inclusions. Comprehensive insurance policies can have varying costs depending on their inclusions, including liability, third party property damage, personal accident, and own damage. People can also opt to get Acts of Nature coverage, making the plan more expensive.

The insurer that the car owner trusts can also affect the insurance plan’s cost since different insurers have different prices for their insurance policies. Comparing insurance lets car owners get more affordable insurance that can sufficiently protect them from any financial damages. To know more about estimating insurance cost, see this infographic by iChoose.ph.